Payroll withholding calculator 2023

Feeling good about your. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

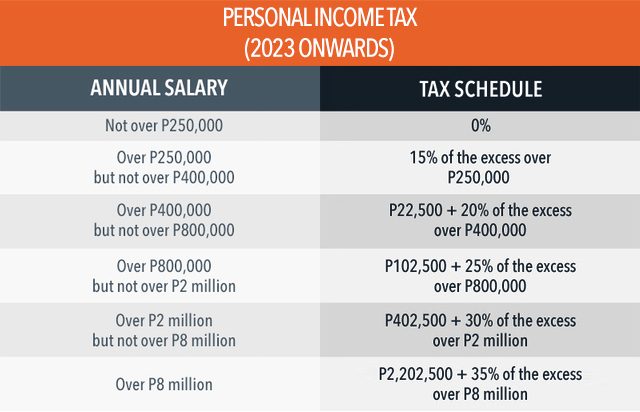

Tax Calculator Compute Your New Income Tax

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding.

. Ad Learn How To Make Payroll Checks With ADP Payroll. Start the TAXstimator Then select your IRS Tax Return Filing Status. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to. Free Unbiased Reviews Top Picks. There are 3 withholding calculators you can use depending on your situation.

Begin tax planning using the 2023 Return Calculator below. Estimate values of your 2019 income the number of children you. Get 3 Months Free Payroll.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Ad Compare This Years Top 5 Free Payroll Software. Get 3 Months Free Payroll.

Tips For Using The IRS Payroll Withholding Calculator. Tips For Using The IRS Payroll Withholding Calculator. The Calculator will ask you the following questions.

2 Calculate Federal Income Tax FIT. For example if an employee earns. 2022 Federal income tax.

Get a head start on your next return. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Ad Learn How To Make Payroll Checks With ADP Payroll.

Free Unbiased Reviews Top Picks. 1400 take that refund amount and divide it by the number of months remaining this year if we are in May you would have 7 months left June -. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary.

There are two main methods small businesses can use to calculate federal withholding tax. The amount of income tax your employer withholds from your regular pay depends. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Fast Easy Affordable Small Business Payroll By ADP. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

2022-2023 Online Payroll Tax. Ad Compare This Years Top 5 Free Payroll Software. Fast Easy Affordable Small Business Payroll By ADP.

Get 3 Months Free Payroll. W-4 Withholding Calculator Updated for 2021 Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Tips For Using The IRS Payroll Withholding Calculator.

How to calculate annual income. Plug in the amount of money youd like to take home. The National Insurance class 1A rate for 2022 to 2023 is 1505.

Sign up for a free Taxpert account and e-file your returns each year they are due. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Free salary hourly and more paycheck calculators.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. It will be updated with 2023 tax year data as soon the data is available from the IRS. Get 3 Months Free Payroll.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Start the TAXstimator Then select your IRS Tax Return Filing Status. For example if you received a tax refund eg.

Thats where our paycheck calculator comes in. The maximum an employee will pay in 2022 is 911400. Subtract 12900 for Married otherwise.

For employees withholding is the amount of federal income tax withheld from your paycheck. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

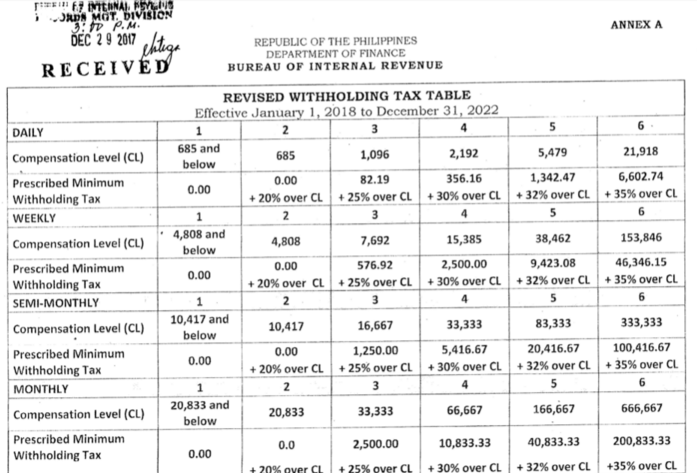

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Income Tax Calculation Financial Year 2022 23 Wealthtech Speaks

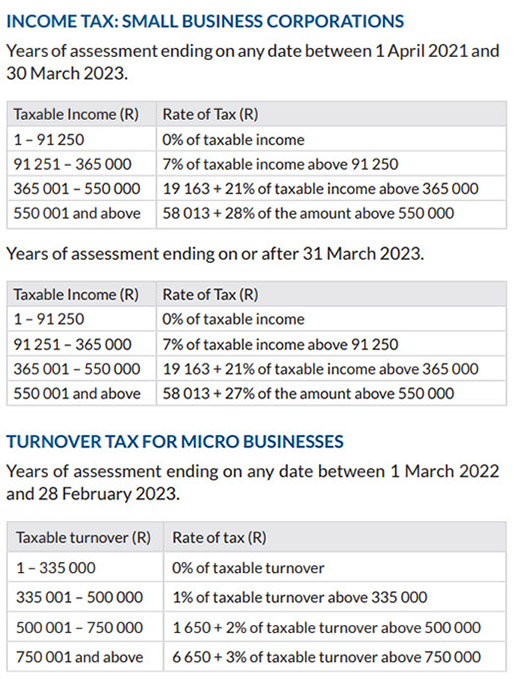

South Africa Tax Calculator 2022 2023 Calculate Your Tax For Free Youtube

How To Determine Your Total Income Tax Withholding Tax Rates Org

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Calculator And Estimator For 2023 Returns W 4 During 2022

Calculator And Estimator For 2023 Returns W 4 During 2022

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Tax Calculator Compute Your New Income Tax

Calculator And Estimator For 2023 Returns W 4 During 2022

2022 2023 Tax Brackets Rates For Each Income Level

Estimated Income Tax Payments For 2022 And 2023 Pay Online