Salary calculator including overtime

How to Calculate Annual Salary to Hourly Here are the steps to converting your annual salary into your hourly wage using a five eight-hour-day workweek and a 29000 annual. The overtime calculator uses the following formulae.

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

For example for 5 hours a month at time and a half enter 5 15.

. WHD will continue to enforce the 2004 part 541 regulations through December 31 2019 including the 455 per week standard salary level and 100000 annual compensation level for Highly. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total.

There are two options in case you have two different. 1830 per month 18304 45750 per week Divide the weeks pay by the number of hours worked ex. Get an accurate picture of the employees gross pay.

1200 40 hours 30 regular rate of pay 30 x 15 45 overtime. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. The employees total pay due including the overtime premium for the workweek can be calculated as follows.

A workman earning up to 4500. The money also grows tax-free so that you only pay income tax when you withdraw. Overtime work is all work in excess of your normal hours of.

You can claim overtime if you are. Divide the pay by four work weeks to get their weekly pay ex. If that salary is paid monthly on the 1st of each month you can calculate the monthly salary by dividing the total salary by the number of payments made in a year to.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. Employees are split into two groups in regards to overtime pay with the critical factors being 1 how they are paid 2 how much they are paid and 3 what their job duties are. Divide the employees daily salary by the number of normal working hours per day.

Enter the number of hours and the rate at which you will get paid. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The adjusted annual salary can be calculated as.

You can claim overtime if you are. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week Overtime Pay Rate OTR Regular Hourly Pay Rate. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

RM50 8 hours RM625. In the Weekly hours field. A non-workman earning up to 2600.

In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result.

Hourly To Salary What Is My Annual Income

Overtime Calculator

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Excel

Hours Wage Calculator Cheap Sale 58 Off Www Wtashows Com

Hours Wage Calculator Sale Online 50 Off Www Wtashows Com

Overtime Pay Calculators

Overtime Calculator To Calculate Time And A Half Rate And More

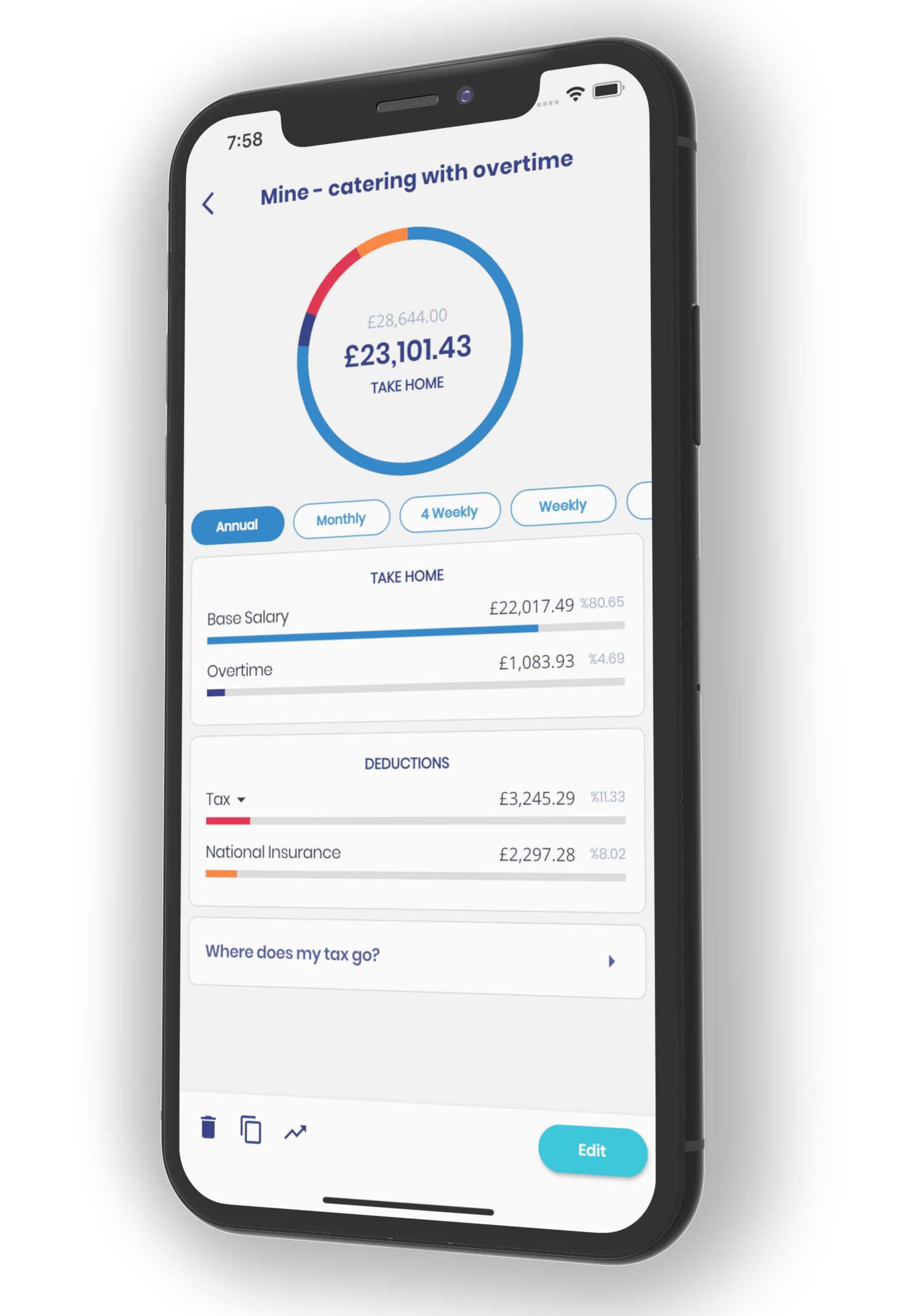

Salary Calculator App

Overtime Calculator

Salary To Hourly Calculator Hot Sale 52 Off Www Wtashows Com

Wage Calculator Sale Online 51 Off Www Wtashows Com

Overtime Pay Calculators

How To Calculate Payroll For Hourly Employees Sling

Hourly To Salary Calculator Convert Your Wages Indeed Com

Overtime Calculator Workest

Hourly To Salary Calculator

Pay Raise Calculator